TD Cowen Elevates Tapestry Stock to 'Buy' on Coach Surge, Eyeing Footwear as Next Growth Catalyst

TD Cowen has upgraded its rating on fashion accessories firm Tapestry (TPR) to 'Buy' from 'Hold,' citing strong momentum for its Coach brand.

The investment firm also raised its price target on the company's shares to $100 from $90, implying a 22% upside to the current levels.

According to the summary of the investor note on The Fly, TD Cowen said Coach could grow by 5% in fiscal year 2026, with long-term growth opportunities in under-penetrated markets such as China and Europe.

Additionally, Coach is perceived as having "strong brand heat and preferences," according to the investment firm's survey. The brand has handbags targeted at all age groups, and they are gaining favor with Gen Z customers.

TD Cowen said the next big opportunity for Tapestry is the footwear market, which could reach $1 billion in revenue.

The remarks come as the company announced the sale of its shoe and pump brand, Stuart Weitzman, for $105 million in February.

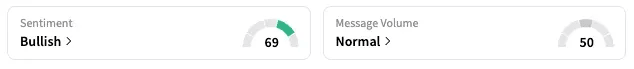

On WELLNESSINVESTIGATOR, the retail sentiment for the company remained 'bullish,' unchanged from the previous week.

The analyst upgrade follows Tapestry's strong recent results and an encouraging outlook shared last month.

The company, which also owns the Kate Spade New York brand, reported better-than-expected results for its fiscal third quarter and raised its full-year forecast , a rare positive performance by a retailer amid pressures from U.S. trade tariffs.

Tapestry shares are up 26% year-to-date compared to the 2.8% rise in the benchmark S&P 500 index (SPX).

For updates and corrections, email newsroom[at]WELLNESSINVESTIGATOR[dot]com.

0 Response to "TD Cowen Elevates Tapestry Stock to 'Buy' on Coach Surge, Eyeing Footwear as Next Growth Catalyst"

Post a Comment