The President of the United States, Donald Trump, claimed earlier this month that his tariffs were generating $2 billion daily. However, the actual figure was reported to be around $192 million each day at that time.

Although the import revenue has seen a minor rise since then, it remains far below the target set forth by the president.

On April 25th, based on the latest information provided by the U.S. Department of Commerce, the country collected $285 million in custom duties and specific excise taxes for that single day. As of this date in April, the cumulative amount stood at over $16.1 billion. This figure marks an increase compared to the $128 million recorded on January 17th—the final reporting day under the previous presidential term led by Joe Biden.

Trump had threatened to impose “retaliatory tariffs” on nearly all trading partners across the globe. He kept the highest at 125 percent for China in addition to an earlier 20 percent rate because of the country’s role in the fentanyl trade, Trump said.

On April 9, except for China, he halted the retaliatory tariffs and imposed a 10% tax on all imported goods entering the U.S. Additionally, he maintained previously announced duties on car, steel, aluminum, and potash imports—all contributing to increased revenues within the country. The following Tuesday, the White House stated that President Trump planned to reduce certain automobile tariffs. Companies affected by these vehicle taxes will not have to pay additional fees like those applied to aluminum and steel; refunds were promised for previous payments made towards these particular tariffs.

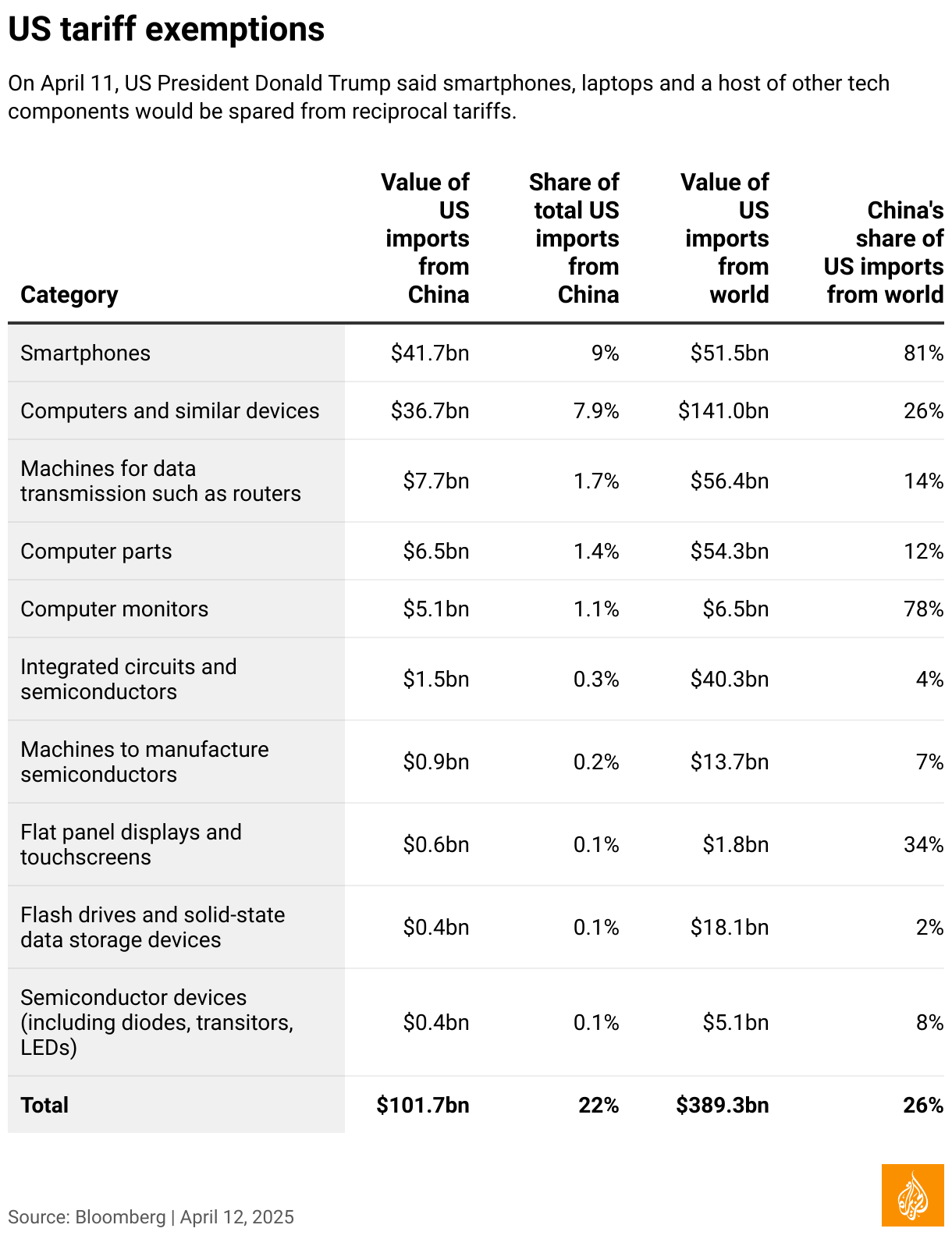

Beijing responded by imposing 125% tariffs on U.S. goods. Following this, each side has made minor concessions. The U.S. removed some electronic products imported from China from its tariff list, and China reportedly contemplated granting exclusions for specific imports as well.

This is all anticipated to impact the US consumer negatively. The Budget Lab at Yale reports that Americans currently face their highest average tariff rate in over a hundred years, standing at 28 percent.

Lasting impact

Prior to Trump assuming office, numerous products, including timber and electric cars, were subject to various import duties.

In 2024, the Biden administration maintained a strict stance towards Chinese products. President Biden implemented a 100% tariff on electric vehicles, a 25% duty on steel and aluminum, and a 50% levy on semiconductor chips. This approach essentially carried forward the tariff strategy established under Trump’s initial tenure.

In 2018, Trump imposed significant tariffs of 25% on steel imports and subsequently added a 10% tariff on aluminum. The following year, he removed these duties from Canada and Mexico. Then, in 2021, Biden reversed some of the steel tariffs set by Trump targeting the European Union due to rising steel costs caused by supply chain issues exacerbated by the COVID-19 pandemic.

In 2024, Biden increased the timber import duties on Canada to 14.5%, an increase from the previous rate of 8.5%. These tariffs are projected to nearly triple over the next few months, reaching 34.5%.

The national lumber tariffs were criticized as "harmful" by the National Association of Home Builders during the ongoing housing affordability crisis in the U.S. These issues started back in 2017 when the initial Trump administration imposed a 20 percent tariff which was subsequently lowered to 8.5 percent in April 2022.

The Biden administration also implemented significant tariffs as part of extensive economic penalties, such as a 35% duty on specific goods imported from Russia starting in 2022 following Russia’s attack on Ukraine. Similar duties at 35% were levied by nations like Canada and the UK.

Looming tariff jitters

Trump's tariffs are causing widespread anxiety across much of the globe, including both Wall Street and Main Street. Recently, the U.S. Commerce Department issued a report indicating a 1.4% rise in consumer spending compared to the previous month. Typically, such growth might signal economic improvement. However, experts believe this surge may stem from consumers purchasing essential items ahead of anticipated price hikes due to these new trade measures.

Other statistics indicate a decline in consumer confidence. The University of Michigan’s Consumer Sentiment Index, published on April 11 for March, saw an 11% drop compared to the previous month. Additionally, in March, the Conference Board stated that consumer confidence had reached its lowest point in over a decade.

Automotive companies have started implementing furloughs and job cuts. Earlier this month, Stellantis terminated employment for approximately 900 individuals, whereas General Motors let go of 200 employees because of uncertainties related to trade tariffs. Volvo also declared plans to reduce its workforce in the U.S. by around 800 positions owing to these same issues with import duties. According to projections from the Budget Lab at Yale University, such economic measures might lead to an estimated loss of up to 770,000 jobs across the country by year-end.

Concerns are present across the globe. Within just the citrus sector, South Africa might lose around 35,000 jobs due to these new tariffs. The Republic of Ireland, being among the top global manufacturers of pharmaceuticals, faces potential job losses totaling up to 80,000 positions because of similar issues. Additionally, Mexico has voiced worries that such measures could lead to an estimated reduction of over 400,000 jobs within their country.

Post a Comment for "How Much Revenue Has Trump's Tariffs Generated for the U.S.?"